How Much Are Property Taxes In South Carolina . The south carolina association of. effective property tax rates. Property tax is administered and collected by local governments, with assistance from the. the millage rate is the tax rate set by each taxing jurisdiction, such as the county, school district, or municipality. Property taxes in south carolina. Looking closer at some of the individual counties in south carolina, horry county has the lowest average. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. The south carolina association of counties (scac) is the only. here are the typical tax rates for a home in south carolina, based on the typical home value of $297,794. calculate how much you'll pay in property taxes on your home, given your location and assessed home value.

from www.crgcompaniesinc.com

The south carolina association of counties (scac) is the only. Looking closer at some of the individual counties in south carolina, horry county has the lowest average. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. the millage rate is the tax rate set by each taxing jurisdiction, such as the county, school district, or municipality. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. The south carolina association of. effective property tax rates. here are the typical tax rates for a home in south carolina, based on the typical home value of $297,794. Property taxes in south carolina. Property tax is administered and collected by local governments, with assistance from the.

Property Taxes South Carolina Ranked 7th Lowest In The Country

How Much Are Property Taxes In South Carolina The south carolina association of. Property taxes in south carolina. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. here are the typical tax rates for a home in south carolina, based on the typical home value of $297,794. effective property tax rates. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Property tax is administered and collected by local governments, with assistance from the. Looking closer at some of the individual counties in south carolina, horry county has the lowest average. the millage rate is the tax rate set by each taxing jurisdiction, such as the county, school district, or municipality. The south carolina association of. The south carolina association of counties (scac) is the only.

From my-unit-property-9.netlify.app

Real Estate Property Tax By State How Much Are Property Taxes In South Carolina effective property tax rates. the millage rate is the tax rate set by each taxing jurisdiction, such as the county, school district, or municipality. Property taxes in south carolina. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. here are the typical tax rates for a home. How Much Are Property Taxes In South Carolina.

From www.youtube.com

So Easy!! South Carolina Property Taxes in 10 Minutes YouTube How Much Are Property Taxes In South Carolina Property taxes in south carolina. The south carolina association of counties (scac) is the only. The south carolina association of. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Looking closer at some of the individual counties in south carolina, horry county has the lowest average. Property tax is administered. How Much Are Property Taxes In South Carolina.

From www.sccounties.org

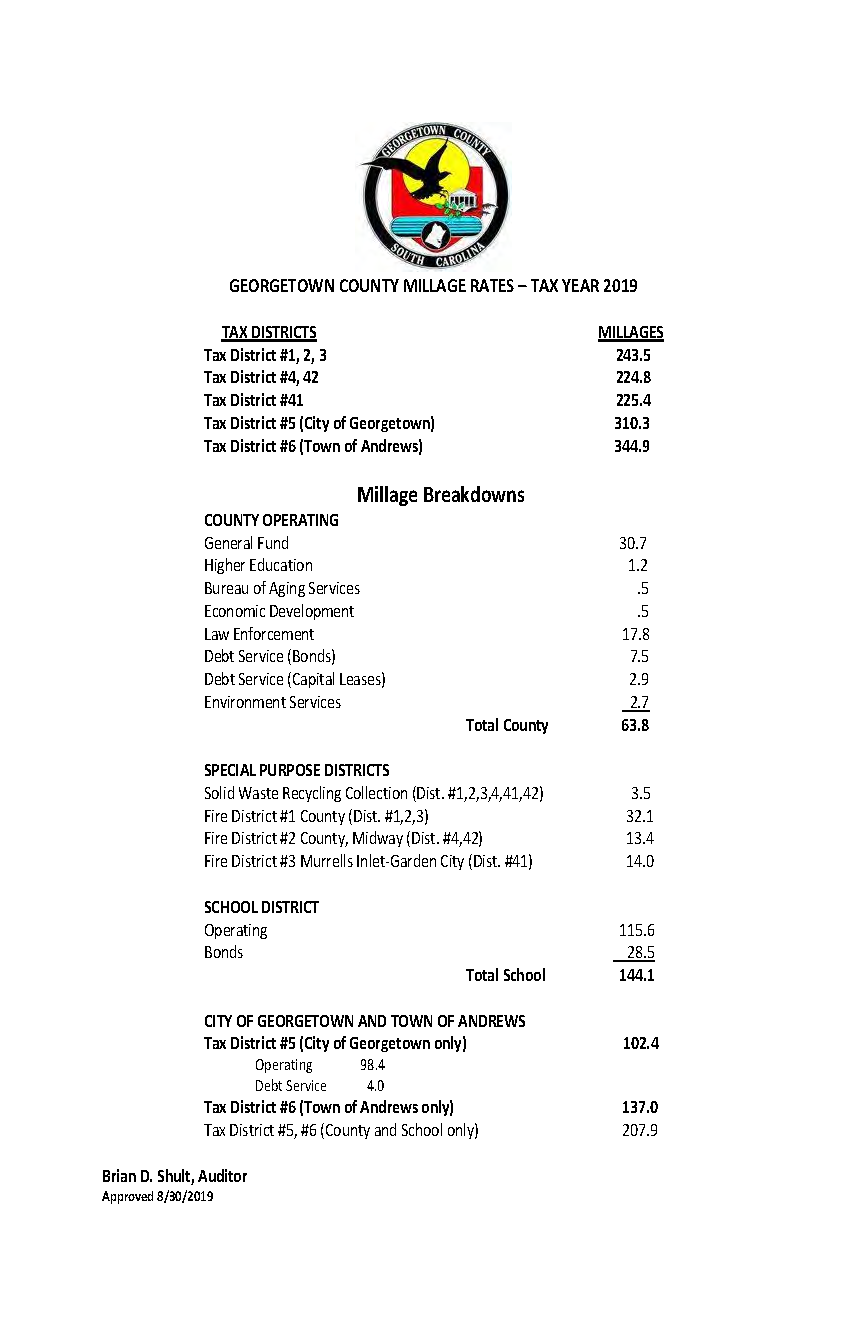

Property Tax Rates by County, 2019 South Carolina Association of Counties How Much Are Property Taxes In South Carolina here are the typical tax rates for a home in south carolina, based on the typical home value of $297,794. The south carolina association of counties (scac) is the only. effective property tax rates. The south carolina association of. the millage rate is the tax rate set by each taxing jurisdiction, such as the county, school district,. How Much Are Property Taxes In South Carolina.

From www.msn.com

9 Things To Know About South Carolina's Taxes How Much Are Property Taxes In South Carolina Property tax is administered and collected by local governments, with assistance from the. effective property tax rates. The south carolina association of counties (scac) is the only. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Looking closer at some of the individual counties in south carolina, horry county. How Much Are Property Taxes In South Carolina.

From www.crghomes.com

Property Taxes South Carolina Ranked 7th Lowest In The Country How Much Are Property Taxes In South Carolina The south carolina association of. effective property tax rates. Property taxes in south carolina. the millage rate is the tax rate set by each taxing jurisdiction, such as the county, school district, or municipality. Property tax is administered and collected by local governments, with assistance from the. our south carolina property tax calculator can estimate your property. How Much Are Property Taxes In South Carolina.

From www.newsncr.com

These States Have the Highest Property Tax Rates How Much Are Property Taxes In South Carolina Property taxes in south carolina. effective property tax rates. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. The south carolina association of. here are the typical tax rates for a home in south carolina, based on the typical home value of $297,794. Looking closer at. How Much Are Property Taxes In South Carolina.

From www.newsandpress.net

A closer look at S.C. and the taxes you pay to live here News and Press How Much Are Property Taxes In South Carolina Property tax is administered and collected by local governments, with assistance from the. The south carolina association of counties (scac) is the only. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. here are the typical tax rates for a home in south carolina, based on the typical home. How Much Are Property Taxes In South Carolina.

From alisunqbarbara.pages.dev

South Carolina Estate Tax Exemption 2024 Janeen Terrie How Much Are Property Taxes In South Carolina Property tax is administered and collected by local governments, with assistance from the. The south carolina association of. The south carolina association of counties (scac) is the only. here are the typical tax rates for a home in south carolina, based on the typical home value of $297,794. the millage rate is the tax rate set by each. How Much Are Property Taxes In South Carolina.

From exogqyjzr.blob.core.windows.net

Which States Have Highest Property Taxes at Dot Taylor blog How Much Are Property Taxes In South Carolina The south carolina association of counties (scac) is the only. Property tax is administered and collected by local governments, with assistance from the. Looking closer at some of the individual counties in south carolina, horry county has the lowest average. The south carolina association of. the millage rate is the tax rate set by each taxing jurisdiction, such as. How Much Are Property Taxes In South Carolina.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation How Much Are Property Taxes In South Carolina our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. Property tax is administered and collected by local governments, with assistance from the. Looking closer at some of the individual counties in south carolina, horry county has the lowest average. the millage rate is the tax rate set. How Much Are Property Taxes In South Carolina.

From www.armstrongeconomics.com

US Property Tax Comparison by State Armstrong Economics How Much Are Property Taxes In South Carolina The south carolina association of. effective property tax rates. Property tax is administered and collected by local governments, with assistance from the. Property taxes in south carolina. here are the typical tax rates for a home in south carolina, based on the typical home value of $297,794. The south carolina association of counties (scac) is the only. . How Much Are Property Taxes In South Carolina.

From www.deskera.com

A Complete Guide to South Carolina Payroll Taxes How Much Are Property Taxes In South Carolina Property tax is administered and collected by local governments, with assistance from the. Property taxes in south carolina. the millage rate is the tax rate set by each taxing jurisdiction, such as the county, school district, or municipality. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. The south. How Much Are Property Taxes In South Carolina.

From www.yoursurvivalguy.com

The Highest Property Taxes in America Your Survival Guy How Much Are Property Taxes In South Carolina our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. Property taxes in south carolina. here are the typical tax rates for a home in south carolina, based on the typical home value of $297,794. The south carolina association of. Property tax is administered and collected by local. How Much Are Property Taxes In South Carolina.

From www.nationalmortgagenews.com

20 states with the lowest property taxes National Mortgage News How Much Are Property Taxes In South Carolina The south carolina association of counties (scac) is the only. Looking closer at some of the individual counties in south carolina, horry county has the lowest average. Property taxes in south carolina. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the millage rate is the tax rate set. How Much Are Property Taxes In South Carolina.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation How Much Are Property Taxes In South Carolina The south carolina association of. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. Looking closer at some of the individual counties in south carolina, horry county has the lowest average. Property taxes in south carolina. the millage rate is the tax rate set by each taxing. How Much Are Property Taxes In South Carolina.

From www.youtube.com

South Carolina State Taxes Explained Your Comprehensive Guide YouTube How Much Are Property Taxes In South Carolina effective property tax rates. The south carolina association of. Looking closer at some of the individual counties in south carolina, horry county has the lowest average. Property taxes in south carolina. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Property tax is administered and collected by local governments,. How Much Are Property Taxes In South Carolina.

From www.crgcompaniesinc.com

Property Taxes South Carolina Ranked 7th Lowest In The Country How Much Are Property Taxes In South Carolina Looking closer at some of the individual counties in south carolina, horry county has the lowest average. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. here are the typical tax rates for a home in south carolina, based on the typical home value of $297,794. effective property. How Much Are Property Taxes In South Carolina.

From lindsaywmaire.pages.dev

South Carolina State Tax Rate 2024 Lucia Rivalee How Much Are Property Taxes In South Carolina Looking closer at some of the individual counties in south carolina, horry county has the lowest average. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. effective property tax rates. Property taxes in south carolina. The south carolina association of counties (scac) is the only. Property tax is administered. How Much Are Property Taxes In South Carolina.